El impacto del Paquete Contra la Inflación y la Carestía en las operaciones de comercio exterior y aduanas

El pasado 4 de mayo de 2022, el Gobierno de la República presentó el “Paquete Contra la Inflación y la Carestía (PACIC)”, en donde se abordan diversas estrategias que incluyen temas aduaneros y de comercio exterior, los cuales se indican a continuación:

1. En la “Estrategia de Producción”, de acuerdo con el punto 4 se pretende suspender por un año la cuota compensatoria en la importación de sulfato de amonio.

En la actualidad, el Sulfato de Amonio sujeto a Cuota Compensatoria son las siguientes:

Como referencia, la SE ha exceptuado el pago de Cuotas Compensatorias por las razones que se mencionan a continuación:

2. En la “Estrategia de Distribución”, conforme al punto 7 se exentará el complemento Carta Porte. El beneficio se encuentra dirigido únicamente a productos básicos e insumos hasta el 1 de octubre de 2022, y de ser necesario se prolongaría por otro periodo.

Desde el 1 de enero de 2022, quienes realicen el traslado de mercancía por carreteras federales se encuentra obligados a declarar en el CFDI de ingreso o de traslado el complemento Carta Porte, salvo las excepciones previstas en la Resolución Miscelánea Fiscal para 2022. Adicionalmente, la autoridad fiscal anunció que si el citado complemento contiene errores no serán aplicadas ningún tipo de sanciones y multas a los contribuyentes hasta el 30 de septiembre de 2022.

Cabe señalar que algunos organismos del sector transporte han planteado cómo funcionará esta facilidad puesto que se utiliza el CFDI complemento carta porte al transportar los productos referidos se hacen con la combinación de otros de manera individual y no individual.

Conforme al punto 9, se pretende efectuar una reducción en costos y tiempo de despacho aduanal, por lo que se busca incrementar el volumen de operaciones en todas las aduanas (fronterizas, marítimas o interiores) y hacer más expedito el reconocimiento aduanero. Adicionalmente, conforme al punto 10 se busca el despacho ágil de carga en puertos marítimos.

3. En la “Estrategia de Comercio Exterior”, se aplicará una medida temporal de aranceles cero a la importación de productos de la alimentación básicos e insumos (21 de 24 productos de la canasta básica y 5 insumos estratégicos):

Recordemos que el Poder Ejecutivo cuenta con facultades para disminuir o suprimir las cuotas de las tarifas de exportación e importación cuando lo estime urgente, a fin de regular el comercio exterior, la economía del país, la estabilidad de la producción nacional, o de realizar cualquiera otro propósito, en beneficio del país.

Algunos de los productos listados se encuentran sujetos al pago del impuesto general de importación conforme a la LIGIE 2020 de acuerdo con lo siguiente:

Debo mencionar, que en la actualidad ciertos productos se encuentran sujetos a aranceles cupo, es decir, que se permite la importación de una cantidad determinada de mercancías con un arancel exento o menor a la tasa general de importación con respecto la LIGIE.

Para finalizar, la Titular de la SE, Tatiana Clouthier mencionó que los cambios verán en aproximadamente entre 15 días y un mes, para que empiecen a surtir efecto de forma integral. Sin embargo, la medida temporal de exención será publicada en el DOF próximamente.[4]

“En TLC Asociados desarrollamos un equipo multidisciplinario de expertos en auditorías y análisis de riesgos para asesorar y promover el cumplimiento en operaciones de comercio exterior”.

Para más información o comentarios sobre esta publicación contacte a:

División de Consultoría

TLC Asociados S.C.

Prohibida la reproducción parcial o total. Todos los derechos reservados de TLC Asociados, S.C. El contenido del presente artículo no constituye una consulta particular y por lo tanto TLC Asociados, S.C., su equipo y su autor, no asumen responsabilidad alguna de la interpretación o aplicación que el lector o destinatario le pueda dar.

On May 4, 2022, the Government of Mexico presented the “Anti-Inflation and High Cost Package (PACIC or Paquete Contra la Inflación y la Carestía in Spanish)”, which addresses various strategies that include customs and foreign trade issues, as indicated below:

1. In the “Production Strategy”, according to point 4, it is intended to suspend for one year the anti-dumping duty on imports of ammonium sulfate.

At present, the Ammonium Sulfate subject to the Countervailing Duty is classified as follows:

| TIGIE (Tariffs of the General Import and Export Tax Law) 2007 | TIGIE (Tariffs of the General Import and Export Tax Law) 2022 | COUNTRY | Federal Gazette of the Federation | COMPANY | Countervailing Duty (CD) |

| 3102.21.01 3105.90.99 | 3102.21.01 3105.90.99 | USA | Final Resolution 31/III/2022 | Honeywell Resins & Chemicals, LLC | Definitive CD of $0.0759 USD per KG. * |

| Other U.S. exporters | Definitive CD of $0.1619 USD per KG. *

*CD continues for 5 more years as of October 10, 2020. |

||||

| 3102.21.01 3105.90.99 | 3102.21.01 3105.90.99 | China | Final Resolution 31/III/2022 | Wuzhoufeng Agricultural Science & Technology, Co. Ltd. | Definitive CD of $0.0929 USD per kg of the NKS mixture.* |

| Other exporters | Definitive CC of $0.1703 USD per KG.* *CD continues for 5 more years as of October 10, 2020. |

As a reference, the Ministry of Economy has exempted the payment of Compensatory Duties for the reasons mentioned below:

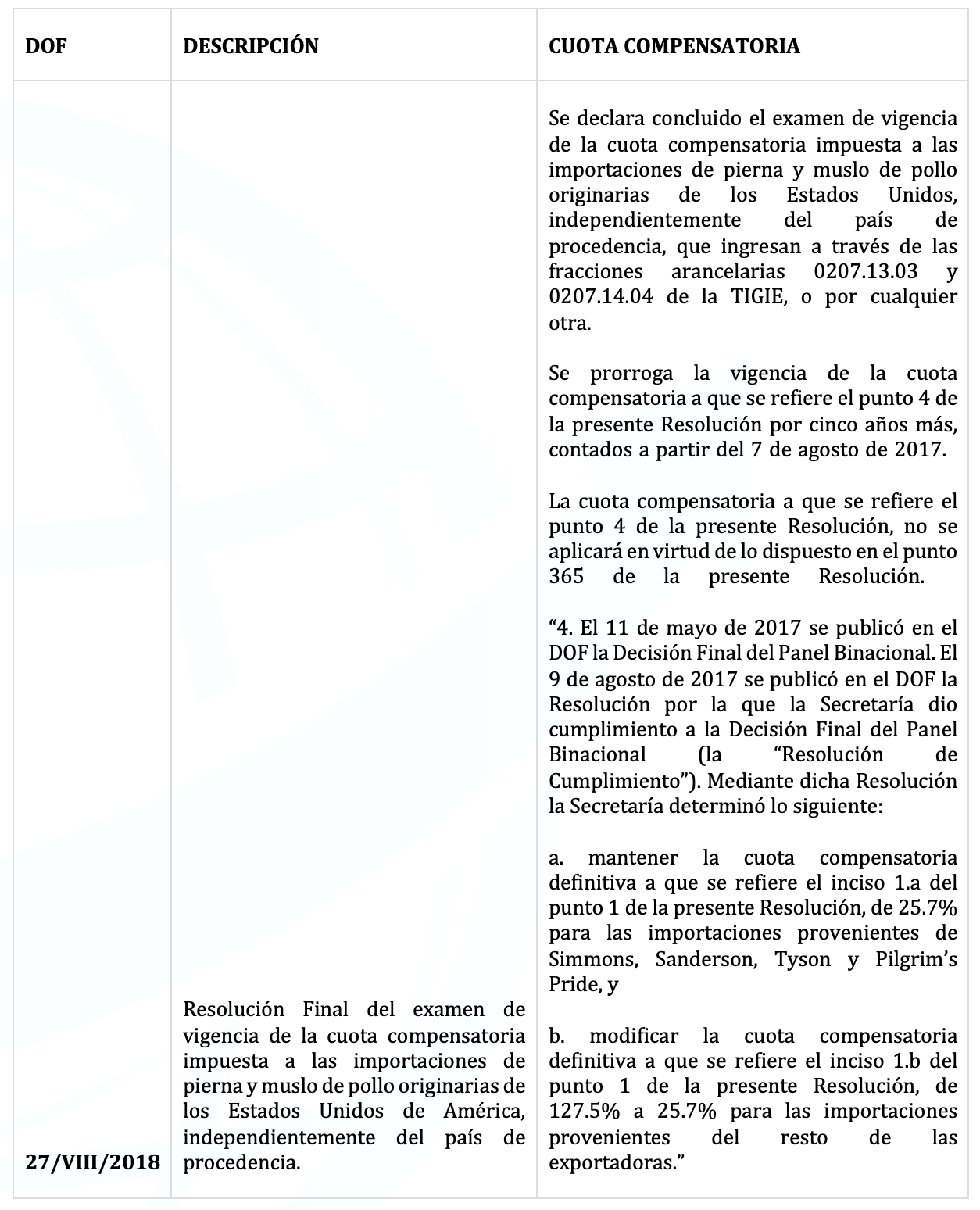

| Federal Gazette of the Federation | DESCRIPTION | COUNTERVAILING DUTY |

| 27/VIII/2018 | Final Determination of the countervailing duty validity review imposed on imports of chicken leg and thigh from the United States of America, regardless of the country of origin. | The review of the validity of the antidumping duty imposed on imports of chicken leg and thigh from the United States, regardless of the country of origin, that enter through tariff items 0207.13.03 and 0207.14.04 of the TIGIE (Tariffs of the General Import and Export Tax Law), or by any other tariff item, is hereby declared concluded.

The validity of the countervailing duty referred to in paragraph 4 of this Resolution is extended for five more years, starting on August 7, 2017. The countervailing duty referred to in paragraph 4 of this Resolution shall not be applied by means of the provisions of paragraph 365 of this Resolution. “4. On May 11, 2017, the Final Decision of the Binational Panel was published in the Official Gazette of the Federation. On August 9, 2017, the Resolution by which the Secretariat complied with the Final Decision of the Binational Panel (the “Compliance Resolution”) was published in the Official Gazette of the Federation. By means of such Resolution, the Secretariat determined the following: a. maintain the definitive countervailing duty referred to in paragraph 1.a of item 1 of this Resolution, of 25.7% for imports from Simmons, Sanderson, Tyson and Pilgrim’s Pride, and b. modify the definitive countervailing duty referred to in paragraph 1.b of point 1 of this Resolution, from 127.5% to 25.7% for imports from the rest of the exporters.” |

| 29/IX/2021 | Final Determination of the antidumping investigation procedure on imports of texturized polyester textile filament yarn originating in the People’s Republic of China and the Republic of India, regardless of the country of origin. | A definitive CD of $0.532 USD per KG that enters through the tariff item 5402.33.01 of the TIGIE (Tariff of the General Import and Export Taxes Law), or through any other tariff item, is imposed. Notwithstanding that all the requirements for the establishment of the countervailing duty were met, as it was established in this Resolution, considering that, derived from the sanitary contingency due to the disease generated by the SARS-CoV2 virus (COVID-19), the textile industry suffered negative effects in all its performance indicators, therefore, in accordance with article 9.1 of the Antidumping Agreement, the Secretariat determines not to apply the countervailing duty established in the previous paragraph of this Resolution for one year as of its publication in the Official Gazette of the Federation. |

2. In the “Distribution Strategy”, in accordance with point 7, the complementary Waybill will be exempted. The benefit is only for commodities and supplies until October 1, 2022, and if necessary, it will be extended for another period.

As of January 1, 2022, those who transport merchandise through federal highways are required to declare, in the Digital Tax Receipt via Internet (CFDI) of income or transfer, the complementary document known as “Waybill”, except for the exceptions set forth in the Miscellaneous Tax Resolution for 2022. Additionally, the tax authority announced that if the mentioned complement contains errors, no penalties and fines will be applied to taxpayers until September 30, 2022.

It should be noted that some organizations in the transportation sector have raised the question of how this facility will work since the Digital Tax Receipt via Internet (CFDI) is used to complement the waybill when transporting the products referred to are made with the combination of others individually and separately.

Point 9 seeks to reduce customs clearance costs and time, by increasing the volume of operations in all customs offices (border, maritime and inland) and expediting customs clearance. In addition, under point 10, the goal is to expedite the clearance of cargo at sea ports.

3. In the “Foreign Trade Strategy”, a temporary measure of zero tariffs will be applied to the import of basic food products and inputs (21 of 24 products of the basic food basket and 5 strategic inputs):

| Food | corn oil, palay rice, tuna, pork, chicken, beef, onion, jalapeño pepper, beans, egg, toilet soap, tomato, milk, lemon, apple, orange, loaf bread, potato, soup dough, sardine, carrot. |

| Inputs | corn flour, wheat flour, white corn, sorghum, wheat. |

We should not forget that the Executive Authority is empowered to reduce or eliminate export and import tariff quotas when it deems it urgent, in order to regulate foreign trade, the country’s economy, the stability of national production, or to carry out any other purpose for the benefit of the country.

Some of the products listed are subject to the payment of the general import tax in accordance with the General Import and Export Tax Law (LIGIE) 2020 as follows:

| Examples: LIGIE Heading or Subheading | Description | Average Tariff | PACIC |

| 15152X | Corn oil | 10 – 20% ADV | 0% ADV |

| 1006 | Palay rice | 9 – 10% ADV | 0% ADV |

| 0301, 0302, 0303, 0304 | Tuna | 0 – 15% ADV | 0% ADV |

| 0203 | Pork | 20% ADV | 0% ADV |

| 02071X | Chicken | 75% ADV | 0% ADV |

| 0201, 0202 | Beef | 20 – 25% ADV | 0% ADV |

| 070310 | Onion | 10% ADV | 0% ADV |

| 070960 | Jalapeño pepper | 10% ADV | 0% ADV |

| 07133X | Beans | 0, 10 – 45% ADV | 0% ADV |

| 040729 | Egg | 45% ADV | 0% ADV |

| 340111 | Toilet soap | 15% ADV | 0% ADV |

| 0702 | Tomato | 10% ADV | 0% ADV |

| 0401 | Milk | 10% ADV | 0% ADV |

| 080550 | Lemon | 20% ADV | 0% ADV |

| 080810 | Apple | 20% ADV | 0% ADV |

| 080510 | Orange | 20% ADV | 0% ADV |

| 1905 | Loaf bread | 10% ADV | 0% ADV |

| 0701 | Potato | 0 – 75% ADV | 0% ADV |

| 1902 | Soup dough | 10% ADV | 0% ADV |

| 0302, 0303 | Sardine | 15% ADV | 0% ADV |

| 070610 | Carrot | 10% ADV | 0% ADV |

| 110220 | Corn flour | 10% ADV | 0% ADV |

| 110100 | Wheat flour | 10% ADV | 0% ADV |

| 1005 | White corn | 0 – 20% ADV | 0% ADV |

| 100710, 100790 | Sorghum | 0 – 10% ADV | 0% ADV |

| 1001 | Wheat | 0 – 15% ADV | 0% ADV |

I should mention that certain products are currently subject to quota tariffs, in other words, the importation of a certain amount of goods is allowed with a tariff exempt or lower than the general import rate with respect to the General Import and Export Tax Law (LIGIE).

Finally, the Head of the Ministry of Economy, Tatiana Clouthier, mentioned that the changes will take approximately between 15 days and a month to take effect in a comprehensive manner. However, the temporary exemption measure will be published in the Official Gazette of the Federation soon.

“In TLC Asociados, we develop a multidisciplinary team of experts in audits and risk analysis for consulting and ensuring compliance with foreign trade operations”.

For further information or comments regarding this article, please contact:

Consulting Division

TLC Asociados S.C.

A total or partial reproduction is completely prohibited. All rights are reserved to TLC Asociados, S.C. The content of this article is not a consultation; therefore, TLC Asociados S.C., its team and its author do not assume any responsibility for the interpretations or implementations the reader may have.

Search

Nuestros servicios

- División de Auditoria Preventiva y de Cumplimiento

- División de Certificaciones OEA-NEEC-CTPAT

- División de Certificación en Materia de IVA/IEPS y Recinto Fiscalizado Estratégico

- División de Blindaje Legal

- División de Consultoría

- División de Lobbying

- Gestoría de Permisos Especiales

- Arquitectura Aduanera

- Revista TLC

- Libros TLC